Do You Want to Know About the JCPenney Credit Card? If yes, this article will help you to know about the JCPenney kiosk store credit card.

Here, in this article, we will share everything related to JCPenney credit cards, such as JCPenney store credit card, how you can get it, and use JCP kiosk credit cards and benefits and perks of it, JCPenney credit card rewards, and many more.

JCPenney Credit Card

The JCPenney credit card is a credit card accepted at JC Penney and Sephora stores and merchandise within JCPenney. You can get many offers through the JCP credit card. It also carries reward points.

When you use it in shopping, you will get some points you can in your next purchase in the Jcpenney kiosk. JCPenney credit card is a card that gives you 1 point per dollar.

Where Can I Use My Jcpenney Credit Card?

You can use JCP credit card on JCPenney, calm, and sephora.com. But you cannot use it in Sephora stores that are standalone outside of JCPenney.

If that makes sense now, JCPenney used to have MasterCard that you could qualify for. I do not believe that they offer that anymore.

I think it is only the JCPenney in Sephora stores that I just talked about that you can use the card in, which is essential to know in terms of rewards.

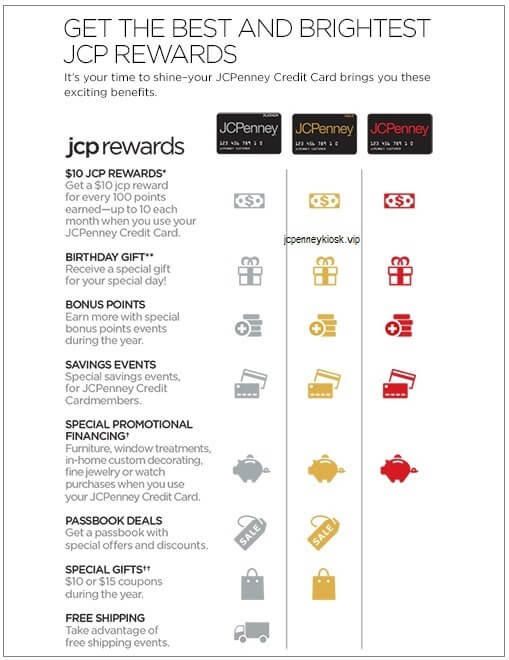

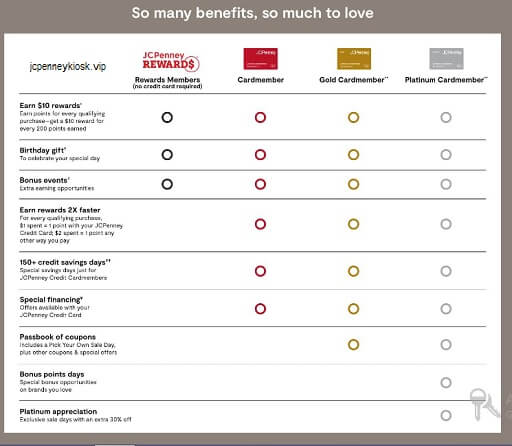

JCPenney Kiosk Credit Card Rewards

You can get many rewards if you use your JCP credit card for the payment in JCPenney stores and online from the www.jcpenney.com website. Following are some offers, scheme, and rewards which you can avail:

- Every time you get up to 200 points, you will get a $ 10 rewards certificate within the JCPenney rewards program. So basically, that means let me spend 200 bucks with the card.

- You are getting ten bucks in future rewards, which is, you know, 5 % of you spend, which I generally think of as sort of the baseline for a retail rewards program.

- If you’re getting 5 % or better, that is a pretty decent return on your money. Now you can pair up these rewards certificates.

- You earn from the credit card and reward certificates that you might achieve through the bonus bucks program at JCPenney with other rewards certificates.

- If you don’t know what bonus bucks are. Specific periods are bonus bucks’ time. If you go in and you spend at least $ 50 at JCPenney or maybe on JCPenney, calm as well.

JCP Credit Card Benefits

Following are the benefits of JCPenney credit card:

- You can get $ 10 in bonus bucks, but those bonus bucks generally have a concise Shelf life, meaning you get them. Then you only have like 4 to 7 days to use them.

- You can get those bonuses, bucks and use them right away. So, if you have rewards certificates from the credit card, you know, saved up, and you get a buck’s opportunity, then you could pair those together and between rewards and bonus bucks.

- You could put them together up to a hundred dollars in merchandise or a larger purchase in terms of a bonus on the JCPenney card.

- If you get it and you are instantly improved, you can use it on the same day to get it. When that happens, you can either take 20 % off your purchases of that on that day of clothing, shoes, standard jewelry, etc or 5 % off bigger things like appliances. There is more expensive wedding jewelry. You get only 5 % off of those, but not a huge bonus, but something nice on you know when you are approved for the card.

JCPenney Kiosk Credit Card Special Offers

In addition to the rewards, you get a special birthday offer some discount or know something on your birthday. Then there are other discounts throughout the year. They will send you various deals and let you know of several offers to jump on if you are willing to. Shop during the periods that they want Synchrony Bank issues you with the card.

Awareness of JCPenney Credit Card?

If you think of applying for a JCPenney credit card, you should be aware of the following things.

Interest Rate

The JCPenney credit card has a very high-interest rate of 25.99%. If you are thinking about getting it, you have to be the type of person that would always pay off this card in full every month. Otherwise, that interest rate is just going to kill you.

It’s going to eat away at any rewards you would earn, and you probably know even more. So, you’ll end up paying even more in interest than rewards that you would get on the flip side of that.

This is a store credit card issued by Synchrony Bank that tends to have sort of losers, standards for getting approved many times.

Credit Score

A store credit card like this will accept people with credit scores that are further down these scales. So, if you’re someone that maybe doesn’t qualify for, you know better credit cards.

Store credit cards can sometimes be a way for you to get into the credit card game and build credit.

The credit card interest rate is pretty terrible, but if you are somebody you know, your credit score is in that, and you can qualify for this card.

It is a possible way for you to build credit as long as you always pay off your complete bill every month.

Rewards & offers

It will be worth it to have a JCPenney credit card for the regular JCPenney shopper, sure, because you’re going to get 5 % rewards. If you are someone that you know goes to JCPenney multiple times, and you can use that reward.

You know in the future and want to use that reward in the future. Then it would make sense to have this card, especially if you are someone who can pay off that complete balance and never pay any interest.

Most Beneficial for Regular Jcpenney Shopper’s

If you’re not a regular JCPenney shopper. The reward you will get is not cashback; it is a reward certificate toward a future purchase.

If you’re not a frequent JCPenney shopper, you know particularly interested in becoming one. Then you don’t care about a reward certificate because you don’t want to go back right.

So, the way you know, maybe you could get something similar or perhaps even better when you shop at JC Penney.

Another credit card that offers higher cashback rates for department store purchases is the US bank cash Plus card, which gives you the choice of getting 5 % cash back in specific categories.

One of those potential choices is department stores which would include JCPenney. So, if you use that at JCPenney, you could, you know, get your 5 % back that way.

CashBack

Instead of getting a reward certificate that would force you to use it at JC Penney, you could earn cash back and use it for whatever you want it to write. Ah, the other way that you can, potentially, you know, get higher cashback when you shop at JCPenney.

Chase Freedom Credit Card

If you have a card like the Chase Freedom Card and possibly the discover it card. You know, here in October of 2018, their fight, one of their five percent categories, is department stores.

So, if you used the Chase Freedom Card at JCPenney at the moment, you would get five percent cash back on your purchases.

If you’re not a regular JCPenney shopper that might be more attractive to you to use a card like get 5 % cashback, you can use it any way you want to, instead of getting a reward certificate that forces you to use it at JCPenny or Sephora.

Final Words

So overall is a pretty standard JCPenney Kiosk store credit card. It provides decent rewards for people and a regular shopper.

They will like it if you’re not a frequent shopper; you might just kind of say, yeah, but if you are somebody who also is, you know your credit? History is not as great, but you know it’s not terrible.

You might qualify for this card, and it could be a way for you to build credit. Then you don’t have a way for you to, you know, buy some things on credit and build up your credit score.

Also, Check:

Can I Apply For A JCPenney Credit Card Online

Can I Use My JCPenney Credit Card at Walmart?

Can I Use My Jcpenney Credit Card At Sephora Online